The global demand for silver is constantly increasing as it is being incorporated into more and more everyday applications and products. The current trend shows a steady increase in the value of silver, and it continues to grow slowly but surely. The time to capitalize on this is now, and one of the best and simplest ways to invest in silver is by buying silver bullion bars.

Sizes of Silver Bars

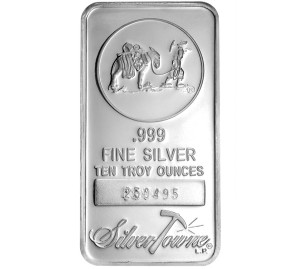

Silver bullion bars are available in standard weights of 1, 5, 10, and 100 troy ounces. They are created by either extrusion or pouring. Pouring tends to create a disparity in weight, so extrusion is preferred for the creation of silver bars. In extrusion, silver is melted down and forced into a mold. Bullion is held to strict standards, and must be at least 99.9% silver to be accepted as bullion.

Silver bullion bars are available in standard weights of 1, 5, 10, and 100 troy ounces. They are created by either extrusion or pouring. Pouring tends to create a disparity in weight, so extrusion is preferred for the creation of silver bars. In extrusion, silver is melted down and forced into a mold. Bullion is held to strict standards, and must be at least 99.9% silver to be accepted as bullion.

Silver bullion bars are a popular form of investment, and some even claim it is the best way to invest in silver. Because these are certified and regulated by marketing bodies, they are guaranteed to hold the purity percentage that they claim to. You can be assured that you are getting exactly what you are paying for. The London Bullion Market Association is one of the governing bodies that set the standard market value for both gold and silver.

Manufacturers

Renowned silver bar manufacturers include the Royal Canadian Mint, Perth Mint, Johnson Matthey, Ohio Precious Metals, Academy and Engelhard. Both the Academy Bar and Sunshine Mint bar are becoming increasingly popular as high quality bars. The Sunshine silver bar is of such perfect and pristine workmanship that the United States government uses their blanks to mint the popular Silver Eagle coin. The Academy Bar imprints a design that allows the bars to interlock when they stack, making storage of large quantities convenient. Silver bars are popular because they are so easy to store.

The advantages of investing in silver bullion bars are that the trading price of the bar correlates to the actual value of the silver itself. Because the purity rating is so high at 99.9%, the bar’s value is a direct reflection of the market value of silver. Silver bars also have a lower premium over spot price compared to silver coins, especially if you buy secondhand or used bars. A lower premium makes it easy for you to buy large numbers of bars at a relatively low price.

Storage

After having bought all of these bars, you’ll need somewhere to store them. Many banks offer options for storage of silver bullion and you can rest easy knowing your silver is safe and easily accessible should you need it. For first time investors, the 10 ounce silver bar is favored as it is saturated enough to be lucrative while still being handy enough to be able to store nearby and provide peace of mind that the investment is safe.

Additionally, physical silver bars offer more security against inflation and fluctuations in market price compared to paper investments. In such a case that traditional markets collapse, possession of silver bars provides you with an insurance of sorts, as your money isn’t all tied up in one venture. Investors include silver in their portfolio for diversification. The Internal Revenue Service also allows you to include silver in your IRA retirement fund. For this purpose, 100 oz silver bars have become popular as ones to include in investment portfolios.